What makes co-lend a

great choice

Proven Track Record

NEXTPAYDAY has played a crucial role in P2p lending in Nigeria. We have already brokered over N3B in loans with 98% collection efficiency.

Safety of Funds

Funds are managed by the nations leading trustee—FBN Quest (First Bank Trustee). This is a symbol of safety and assurance. Futhermore; all loans have an hybrid credit risk guarantee. Your funds are fully protected.

Re-invest to Boost

Re-invest your monthly funds flow to back new loans and experience exponential growth in your portfolio.

Stable and High Returns

We fund loans to salary earners only with recovery from payroll and salary account Guaranteed return per loan is 30%.

Fully Automated Investment

We have created auto-invest tool that will make your money work for you based on set investment parameters. Once settings is completed; sit back and watch your money grow.

Make an Impact

In Nigeria, monthly wages are extremely low. When you invest in personal loans, you help real people. This enable them meet their financial objective, safe life and reduce crime.

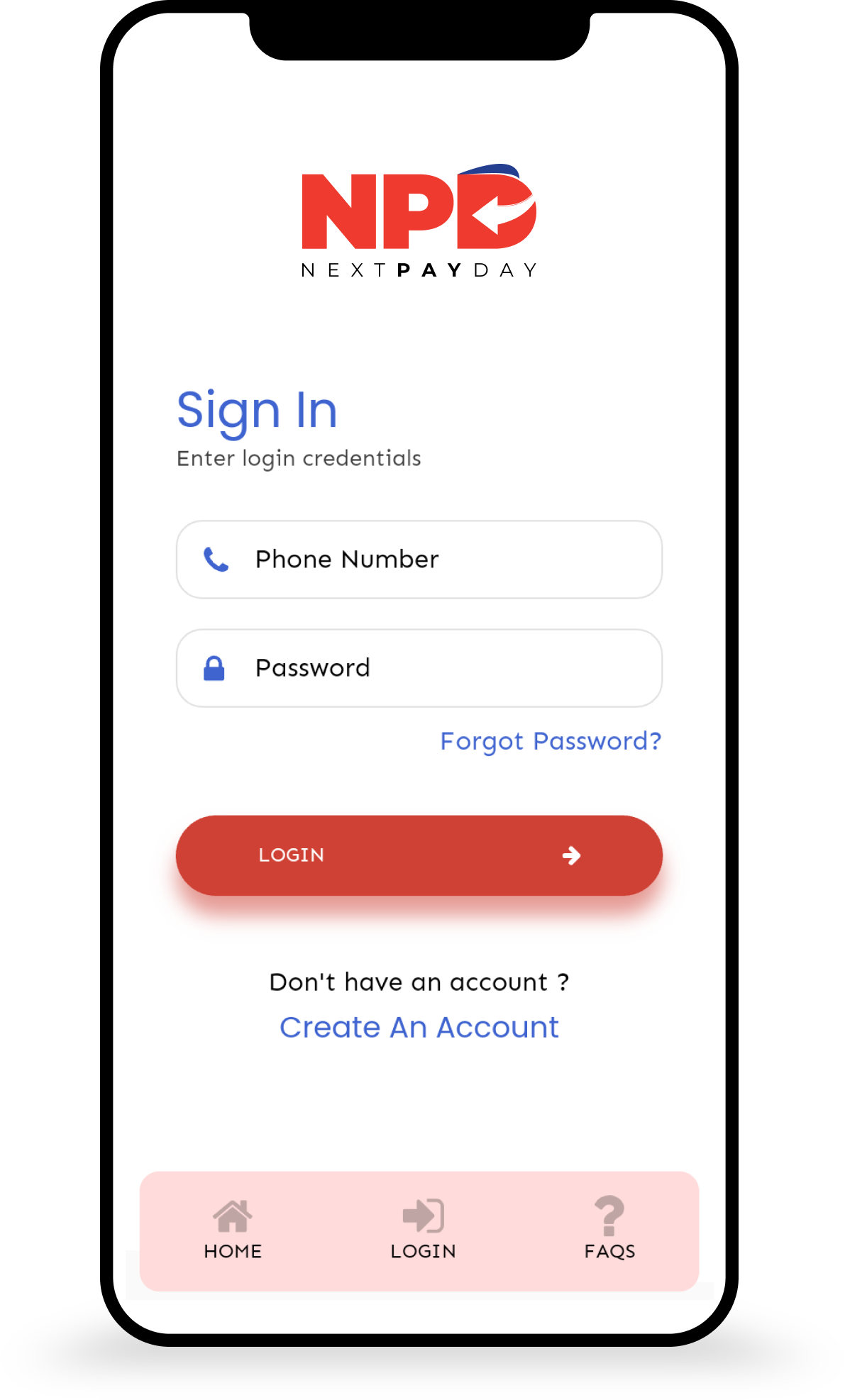

Becoming a co-lender

is simple

as ABC

Create an account

Creating an investor account takes a few minutes, a few information and identification will do.

Transfer funds and start lending

Funds are managed by the nations leading trustee—FBN Quest (First Bank Trustee). This is a symbol of safety and assurance. Futhermore; all loans have an hybrid credit risk guarantee. Your funds are fully protected.

Start earning returns

NEXTPAYDAY will help you grow your money. Back a loan, get paid back and enjoy unbeatable passive income better than savings, fixed posits, treasury bills, shares . It’s a new asset to treasure.

Lend with nextpayday

Better way to grow your money non-speculative, secured, and high yield alternative finance Thank you for lending with us

Lend with nextpayday is a new call to action for micro investors to earn more by funding a nextpayday loan, wholly or partly

Key features:

- - Earn all loan interest

- - Re-invest to boost

- - Pays a 30% commission on interest earned on collected EMI.

Assurances

- - Escrow services with FBNQuests holds all funds

- - All funded loans are fully insured, hence, your investments.

Earning potential

- Over 30% per annum

Risk profile

- - Defective KYC [ nextpayday indemnify lenders against such loss ]

- - Defective collection [ WEMA bank GSI partnership kicks in]

- - Non remittance, especially on payroll loans [ alternative collection method kicks in]

Strength

- - All loans are fully verified. Employment check, capacity check and credit checks are conducted

- - Dual recovery channels for all loans, including GSI

- - We lend to verifiable users.

- - Approval of States [Rivers, Cross Rivers, FGN] affords us access to payroll for first right of payment.

- - Micro-loans enhances full portfolio diversification.

- - Access to investors dashboard. You can follow up on your transactions anywhere, anytime.

- - Now, every one can invest with our robust micro-investors scheme.

Thats for the co-lend fund

Colend Note

These are high yield, non speculative, secured promissory

Notes with predefined payout date and values.

Below are the key features

Key features:

- - Optional upfront, monthly and backend Interest payout

- - Tenors are 180/360 days

- - Note can be rolled over on maturity

- - Preliquidation is at the discretion of nextpayday

- - All Promissory Notes with values in excess of N10m gets further back up with FBNQuest investment confirmation Letter

- - There are no charges or commission payable by note holder

- - It has a 100% payment guarantee irrespective of loan status

- - Nextpayday has right to pause interest payments in the event of pandemic, force majore or other events that leads to shut down of business, pandemic, unrest etc.

- - Payday Notes are debt stock to Nextpayday

-

Starters

Investment stats from N50,000

Lend with nextpayday

Better way to grow your money non-speculative, secured, and high yield alternative finance

Learn More

Download the

NEXTPAYDAY app.